Institute for Money, Technology,

& Financial Inclusion

University of California, Irvine

School of Social Sciences

3151 Social Science Plaza

Irvine, CA 92697-5100

949 824-2284

Staff- Jenny FanInstitute Administrator

- Mrinalini TankhaPostdoctoral Scholar

- Nate CobenGraduate Research Assistant

- Nathan DobsonGraduate Research Assistant

- Stephen ReaGraduate Research Assistant

Welcome to the Fall 2014 newsletter from the Institute for Money, Technology & Financial Inclusion! So much has happened in the mobile money space in the past twelve months, it’s hard to keep up. I know, I know—you’re probably thinking ApplePay; the spinning off of PayPal from eBay; something, anything, about bitcoin, or maybe that hurried rebranding of ISIS into Softcard.

I think there’s been even bigger news, however, with the potential to fundamentally reshape the lives millions around the world, not just Whole Foods shoppers in suburban Palo Alto or the privileged few controlling the big bitcoin mining pools. Safaricom, Kenya’s largest mobile money provider, opened up its extensive agent network to rivals Orange and Airtel. M-Pesa agents are now allowed to sell these telcos’ other mobile money products. This is a win for consumers and competition in the mobile money marketplace. The Reserve Bank of India issued draft guidelines for the creation of “payment banks,” a new kind of entity that will potentially revolutionize the provision of branchless banking services in that gigantic, populous country. And, in the realization of a dream long held by some mobile money promoters, Tanzania’s Tigo launched a mobile money service that pays interest. It's being introduced as “comply[ing] with all our customers' cultural or personal beliefs,” and users can choose to donate the money to Tigo's social projects, which changes the game for what mobile money can do re: as a collaborative financial inclusion tool.

It may not sound like much—no finger print scan to tap your phone to a POS device that… wait, how does this work again? You mean I have to enter all my credit card info into on this tiny touchscreen keyboard? Tap what, where… ummm, let me just get some cash…Ahem. They may not sound like much, but these developments represent big shifts in the mobile money business that may have a tremendous reach and impact in the months and years to come. And our researchers will be there, observing, interviewing, collecting qualitative and statistical data, and integrating their analyses with those of their colleagues in our network and beyond.

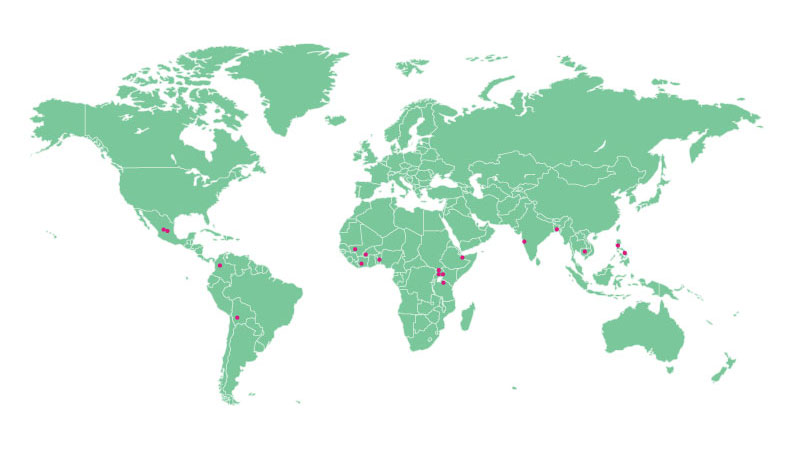

It’s been a busy year for IMTFI, too. With 21 new projects funded in 2014, we now have a total of 123 projects in 41 countries, with support for over 160 researchers since our founding in 2008. Our researchers have published new books, tons of articles and reports, and are exploring new formats for the dissemination of their research results as well as for the provision of financial education. Take a look at our new executive summary of our research to date on gender and financial inclusion, "Snapshots of Gender and Financial Inclusion". We were also recognized by The Guardian as one of the top ten financial inclusion Twitter streams—so, if you’re not doing so already, please follow us!

Join us for our annual conference in December 2014 in person or online and stay tuned for our seventh annual Call for Proposals coming up, announcement coming soon!

Bill Maurer

Director