Institute for Money, Technology,

& Financial Inclusion

University of California, Irvine

School of Social Sciences

3151 Social Science Plaza

Irvine, CA 92697-5100

949 824-2284

Staff- Jenny FanInstitute Administrator

- John SeamanAdministrator

- Ursula DalinghausPostdoctoral Scholar

- Mrinalini TankhaPostdoctoral Scholar

- Nandita BadamiGraduate Research Assistant

- Nathan DobsonGraduate Research Assistant

- Stephen ReaGraduate Research Assistant

Welcome to the Spring 2015 newsletter from the Institute for Money, Technology & Financial Inclusion! Our sixth annual conference drew over 128 participants, including 31 researchers from 13 countries. Researchers presented work as varied as an inquiry into mobile phones and divination in northern Ghana to the use of comedy TV shows to promote financial literacy in Cambodia. It was an exhilarating and busy three days of sharing, networking, forging new insights and building new collaborations.

Our seventh call for research proposals is in full swing, and we’re looking forward to this next round of projects. Meanwhile, we’ve been synthesizing lessons learned, gathering insights from our researchers on the IMTFI “special sauce” of capacity building, collaborative mentoring and research dissemination, and spreading the word of how in-depth, locally grounded studies of the lives of the poor can meaningfully impact policy and the design of new services and products for financial inclusion.

To that end, I was pleased to present at a recent convening at the Bill and Melinda Gates Foundation about some of the crucially important but often under-appreciated aspects of money, technology and financial inclusion coming out of our research. For instance, social hierarchies matter—they really, really matter—in determining whether and when people will pick up a new mobile money service, who adopts it, and on what basis trust can be built. From elders and dead ancestors rejecting the use of the phone to discuss a death or to pay homage to an elder, to low-ranking wives in polygynous marriages sending money to high-ranking wives, to church leaders promoting mobile money use, we continually find that the specifics of who is perceived to outrank whom, and why, can put up barriers but also sometimes accelerate mobile and digital financial service adoption. Mobile money also lets people get things done that they would not otherwise have the freedom to do, given its relative “invisibility.” Yet in some circumstances—church donations come up again and again—people want to see and feel the tangibility of paper cash and metal coin.

A recent Guardian forum underscored some of the basic requirements of any digital financial service: you need reliable electricity and network coverage. All it takes is one failed transaction to shake a potential customer’s trust. We’ve been hearing more and more about smartphones, too—yet they are power hogs, requiring daily charging. After our online forum, the Guardian put phone charging at the top of its list of "10 Barriers to Using Mobile Technology to Fight Inequality.”

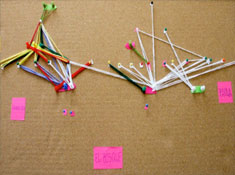

Read on to learn more about Erin Taylor’s new Consumer Finance Research Toolkit, currently under development, to catch up on the latest IMTFI research, and to see Sibel Kusimba’s fantastic videos of social networks and M-Pesa use in Kenya and webinar with M-Changa. We’ve also made a video of our own! We think it helps highlight how one of IMTFI’s contributions is the networks we form and plug into, as a vital complement to all the good work that is being done in this space. We are empowering, capacity building, and connecting, and providing a place for voices to be heard and developed that would otherwise not make it to the table.

Bill Maurer

Director