By Sunniva Sandbukt (Assistant Professor at the IT-University of Copenhagen)

This blogpost draws on fieldwork conducted in Yogyakarta, Indonesia, between 2018

and 2019 for the author’s PhD.

Enter E-Money

The use of “e-money” in Indonesia began in 2007. In 2009, uang elektronik (electronic money) was given a distinct legal definition apart from the type of digital

money used with credit, debit, and ATM cards (BI 2009). Defined as a means of payment,

e-money is stored electronically (for instance, on a server) and functions practically

as a type of digital credit that can be purchased from licensed companies and usually

accessed through an app. Once purchased, this money can only leave the app in the

form of payment to an affiliated merchant, unless the customer has upgraded their

account. In this way, e-money operates similarly to gift cards—money that has been

earmarked for a specific purpose (Zelizer 1995).

The discourse around digital payments in Indonesia has emphasized developing toward a “less-cash” society (BI 2014; SNKI 2017). In a context dominated by cash, and where few people have access to credit cards, e-money represents a novel alternative to cash-based transactions (Azali 2016; Demirgüç-Kunt et al. 2018). However, while the e-money transacted through these apps may be denominated in state-issued rupiah, it is being transported within a privately controlled infrastructure.

I want to highlight two characteristics of e-money. First, these cashless transactions do not replace cash. On the contrary, the circulation of digital money is intimately entangled with the circulation of both cash and human labor. Second, in their conversion of cash into digital credit, these app companies not only change what this money is but also exert influence over its value. Both characteristics are contributing factors to different experiences of participation in the digital economy.

Cash-Filled Cashless Transactions

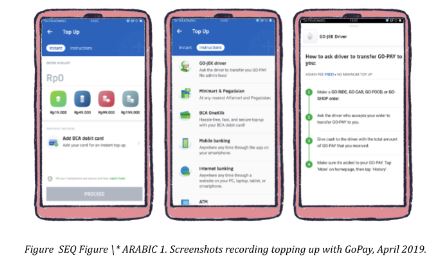

As an e-money customer of platforms like Gojek or Grab, you first have to “top up”

your saldo, or digital balance. For users who do not have a debit or credit card, an accessible

way to do so is by purchasing credits directly from the on-demand drivers who work

for the app. When pressing the “top up” instructions in the Gojek app menu, topping

up with a driver is the first suggested method, and the only method that does not

include fees.

In practice, the customer purchases e-money directly from the balance belonging to the driver. In other words, the driver is not issuing new credit but typically reselling e-money, which they have earned from completed trips, in exchange for cash. Though customers can use these apps without connecting their accounts to a bank account, a bank account is a requirement to be a driver. This is because drivers must be able to withdraw digital earnings, first by making a cash-out request, and then by withdrawing their money from an ATM. Thus, it is drivers who must bear the transactional costs of converting this digital income into the cash they need for their daily expenses.

For drivers, then, selling their balance directly to a customer can serve as a shortcut to convert their digital earnings into tangible cash. The companies further incentivize drivers to sell their balances—for instance, through bonus points or by depositing percentage-based “cashbacks” directly into their digital wallets. Therefore, some drivers are strategically proactive in encouraging customers to purchase digital credit, ironically operating on the front lines of the push for a cashless economy in their pursuit of cash. While drivers operate as human ATMs for digital money (Maurer et al. 2013), they are also using the infrastructural mechanisms of the app to serve their own needs, effectively converting their customers into ATMs for cash.

“It’s Cheaper That Way”

When customers purchase goods or services through these apps, they are offered the

choice of paying either with cash or e-money. The question then becomes: If a customer

is paying a driver cash for an e-money top up to be used on their next trip, why not

just pay the driver cash directly each time? Certainly, there are conveniences to

having digital money stored within an app, but it also requires financial liquidity

to maintain credit balances across multiple apps.

What the apps offer, besides the convenience of making such payments digitally, are discounts, promos, and “cashbacks” for purchases paid digitally. The apps actively incentivize the use of digital money by reducing the costs of services paid for digitally. Thus, the choice to pay either using cash or e-money is not neutral, or just a choice of convenience. Digital money increases the purchasing power of your rupiah by making “things” cheaper. As one driver described his method for persuading customers to purchase the e-money used in the Grab app:

“for instance, if they use cash, they pay with cash, we pretend to persuade them, ‘Do you not use OVO? It’s cheaper that way, you know.’ That’s how we persuade them, so they’d fill their OVO.”

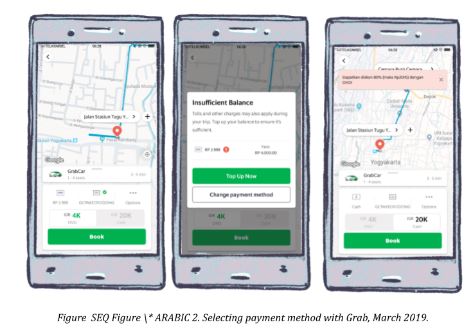

Not only do the apps reduce the cost of purchases paid for using e-money, but they

also communicate this price difference intensively through the interface—for instance,

highlighting the price differences in red and green, or even drawing attention to

how much more a cash payment will cost you as a consumer, reminding you to keep your

balance topped up to benefit from the discounts. The price difference can be significant,

and the result is that customers are encouraged to continuously exchange their cash

for digital money to preemptively maintain a liquid digital balance in order not to

miss out on these cheaper services. Thus, the real value proposition of e-money cannot

be reduced to it being digital, and therefore convenient. The real value for customers

lies in its ability to provide access to cheaper services and products.

Experiential Differences

Participation in a cashless economy is not a universal experience; a technology that

makes life more convenient and affordable for some can greatly complicate the lives

of others. By displacing transactional costs onto drivers, these companies can provide

both convenient and cheap services for their customers. Ultimately, it is this transactional

constellation that is valuable to the companies, as customers and drivers both keep

money circulating in the platform, thus generating transactional metadata (O’Dwyer

2018). The cashless economy is enabled not just through digital technology but also

largely by its existing context of social infrastructure and the continuous circulation

of cash itself.

Bibliography

Azali, K. 2016. “Cashless in Indonesia: Gelling Mobile E-frictions?” Journal of Southeast Asian Economies 33:364–86. https://doi.org/DOI: 10.1355/ae33-3e.

BI. 2009. Peraturan Bank Indonesia No.11/12/PBI/2009 Uang Elektronik (Electronic Money).

BI. 2014. “Press Release: Bank Indonesia Launches National Non-Cash Movement.” bi.go.id.

https://www.bi.go.id/en/ruang-media/siaran-pers/Pages/sp_165814.aspx.

Demirgüç-Kunt, A., L. Klapper, D. Singer, S. Ansar, and J. Hess. 2018. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution.

Washington, DC: The World Bank.

Maurer, B., T. C. Nelms, and S. C. Rea. 2013. “‘Bridges to Cash’: Channelling Agency

in Mobile Money.” Journal of the Royal Anthropological Institute 19:52–74. https://doi.org/10.1111/1467-9655.12003

O’Dwyer, R. 2018. “Cache Society: Transactional Records, Electronic Money, and Cultural

Resistance.” Journal of Cultural Economy 12:133–53. https://doi.org/10.1080/17530350.2018.1545243.

SNKI. 2017. “Inclusive Finance.” SNKI. https://snki.go.id/keuangan-inklusif/.

Zelizer, V. A. R. 1995. The Social Meaning of Money. New York: Basic Books.

This work was conducted as an independent 2022 research project on central bank digital currency and financial inclusion, in collaboration with Maiden Labs, the MIT Digital Currency Initiative, and the Institute for Money, Technology & Financial Inclusion, and funded by the Gates Foundation. You may view the context of this study on the IMTFI blog and details of the new research report release here.

Original blogpost published on the IMTFI Blog on March 6, 2023 can be found here: CBDC Field Research Insights: Hierarchies of Participation: Experiences with Cashlessness in Indonesia